Welcome to this comprehensive guide on the best forex brokers in the USA. In the world of foreign exchange trading (forex), choosing the right broker is crucial for your success. With too many options available, it can be overwhelming to make a decision.

That’s why we have done the research for you, analyzing and reviewing the top forex brokers in the USA to help you make an informed choice.

In this article, we will provide you with a detailed overview of the best forex brokers in the USA, highlighting their key features, trading platforms, regulations, customer support, and more. Our aim is to equip you with the necessary knowledge and insights to select a broker that aligns with your trading goals and preferences.

Whether you are a beginner looking for a user-friendly platform, an experienced trader seeking advanced tools and features, or someone interested in specific trading instruments, we have got you covered.

We understand that regulation is of utmost importance when it comes to choosing a forex broker.

Therefore, we will emphasize the regulatory bodies overseeing the brokers we review, ensuring that they are authorized and compliant with the necessary regulations in the USA. This will give you peace of mind knowing that your funds are secure and your trading activities are conducted within a regulated environment.

Our intention is to provide you with an unbiased and objective assessment of each broker, presenting both the strengths and weaknesses of their services. We understand that different traders have different requirements, and what may work for one trader may not work for another. By presenting a variety of options, we aim to cater to a wide range of trading styles and preferences.

So, whether you are looking for a broker with low spreads, competitive fees, a wide range of trading instruments, or comprehensive educational resources, we have evaluated them all. Our goal is to empower you with the necessary knowledge to make an informed decision and ultimately enhance your trading experience.

Stay tuned as we delve into the top forex brokers in the USA, highlighting their unique features and benefits. By the end of this guide, you will be equipped with the insights needed to choose the best forex broker that suits your trading needs and goals. Let’s get started on your journey towards successful trading in the dynamic world of forex.

How to Choose the Right Broker

When it comes to selecting the best forex broker in the USA, there are several factors that you need to consider. Making the right choice is crucial for your success in trading, as the broker you choose will directly impact your trading experience and overall profitability.

Feel free to skip this section directly to the top brokers list below!

Here are some key factors to keep in mind when choosing a forex broker:

Regulation and Security: The first and most important factor to consider is the broker’s regulation and security. Ensure that the broker you choose is regulated by a reputable financial authority, such as the Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA) in the USA. Regulated brokers adhere to strict guidelines and offer a higher level of protection for your funds.

Trading Platform: The trading platform provided by the broker is the primary tool you will use for executing trades. It should be user-friendly, reliable, and equipped with essential features such as charting tools, technical indicators, and order execution capabilities. Test out the broker’s demo account to get a feel for their trading platform and ensure it meets your requirements.

Range of Tradable Instruments: Different brokers offer varying ranges of tradable instruments, including currency pairs, commodities, indices, and cryptocurrencies. Consider your trading strategy and preferred asset classes, and choose a broker that provides a diverse range of instruments that align with your trading goals.

Spreads and Fees: Forex brokers make money through spreads, which are the differences between the buy and sell prices. Lower spreads mean lower trading costs, so it’s essential to compare the spreads offered by different brokers. Additionally, consider any commission charges, withdrawal fees, or other hidden costs that may impact your profitability.

Leverage: Leverage allows you to control a larger position with a smaller amount of capital. However, leverage can magnify both profits and losses, so it’s crucial to choose a broker that offers suitable leverage options for your risk tolerance and trading style. Ensure that the broker’s leverage offerings comply with the regulations set by the authorities.

Customer Support: Reliable customer support is vital when it comes to resolving issues or seeking assistance with your trading account. Look for brokers that offer multiple channels of communication, such as phone, email, and live chat, and ensure that their support team is responsive and knowledgeable.

Reputation and Reviews: Before making a final decision, research the broker’s reputation and read reviews from other traders. Consider the overall feedback, both positive and negative, to get a comprehensive understanding of the broker’s strengths and weaknesses.

By carefully considering these factors, you can choose a forex broker in the USA that aligns with your trading goals and provides a secure and reliable trading environment. Remember, the right broker can play a significant role in your trading success, so take your time and make an informed decision.

Interactive Brokers

Interactive Brokers is a well-established and renowned broker in the Forex industry. Founded in 1978, it has a long and successful track record in providing trading services to retail and institutional clients. With its headquarters in the United States, Interactive Brokers operates in multiple countries globally, making it a popular choice among traders worldwide.

One of the key strengths of Interactive Brokers is its advanced trading platform. The broker offers a range of trading platforms, including the highly acclaimed Trader Workstation (TWS) and WebTrader. These platforms are known for their robustness, speed, and extensive range of features. Traders can access a wide range of markets, including Forex, stocks, options, futures, and more, all from a single account.

Interactive Brokers is also known for its competitive pricing. The broker offers some of the lowest spreads in the industry, making it an attractive choice for cost-conscious traders. Furthermore, Interactive Brokers operates on a transparent commission-based pricing model, which ensures that traders have a clear understanding of the fees they are paying.

Key Benefits:

- Extensive range of financial instruments. Traders have access to over 135 currency pairs from major, minor, and exotic currencies, enabling them to diversify their trading portfolios.

- Powerful trading platform called Trader Workstation (TWS). This platform offers advanced charting tools, real-time market data, customizable layouts, and a wide range of order types, allowing traders to execute their strategies efficiently.

- Competitive pricing, making it an attractive choice for cost-conscious traders. IB charges low commissions on trades and offers tight spreads, ensuring that traders can keep their trading costs to a minimum.

- Direct market access (DMA), allowing them to trade directly with liquidity providers without any intermediaries. This ensures fast execution and reduces the likelihood of requotes or slippage.

- For traders who prefer automated trading strategies, IB offers an API (Application Programming Interface) that allows them to connect their own trading algorithms to the broker’s systems. This feature is particularly useful for algorithmic traders who want to execute trades automatically based on predefined rules.

- Wide range of educational resources to help them enhance their trading skills. These resources include webinars, video tutorials, articles, and interactive courses that cover various aspects of trading, including technical analysis, risk management, and trading psychology.

- Comprehensive research and analysis toolkit that includes real-time news, market commentary, and fundamental data. Traders can access these tools to stay updated with the latest market developments and make informed trading decisions.

- Strong focus on regulatory compliance and investor protection. The broker is regulated by multiple financial authorities, including the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), providing traders with confidence in the safety of their funds.

- Customer support is available 24/7 through various channels, including phone, email, and live chat. Traders can reach out to the support team for assistance with account-related queries, technical issues, or any other concerns they may have.

Pros

- Wide range of financial products available for trading

- Competitive pricing and low commissions

- Advanced trading platform with customizable features

- Efficient order execution and fast trade executions

- Strong regulatory oversight and reputable brokerage

- Access to a variety of global markets and exchanges

- Robust trading tools and research resources

- Excellent customer support services

- Availability of demo account for practice trading.

Cons

- High minimum deposit requirement

- Complex and difficult to use platform

- Limited customer support options

- Inactivity fees

- Lack of educational resources for beginners

- Limited range of tradable assets

- High fees for non-US residents

- Not user-friendly for casual traders

My Recommendation

I have had the opportunity to use Interactive Brokers for trading in the Forex market, and overall, I have been very impressed with their services. The platform is highly advanced and offers a wide range of tools and features that are essential for successful trading. The user interface is intuitive and customizable, allowing me to set up my workspace according to my preferences.

One of the standout features of Interactive Brokers is their low commission rates, which are among the most competitive in the industry. This has significantly reduced my trading costs and allowed me to maximize my profits. Additionally, their customer support team is always available and responsive, providing prompt assistance whenever I had any queries or issues.

TD Ameritrade

TD Ameritrade is a well-established and highly reputable broker in the Forex industry. With a history dating back to 1975, TD Ameritrade has built a solid reputation for providing comprehensive trading services to both individual and institutional traders.

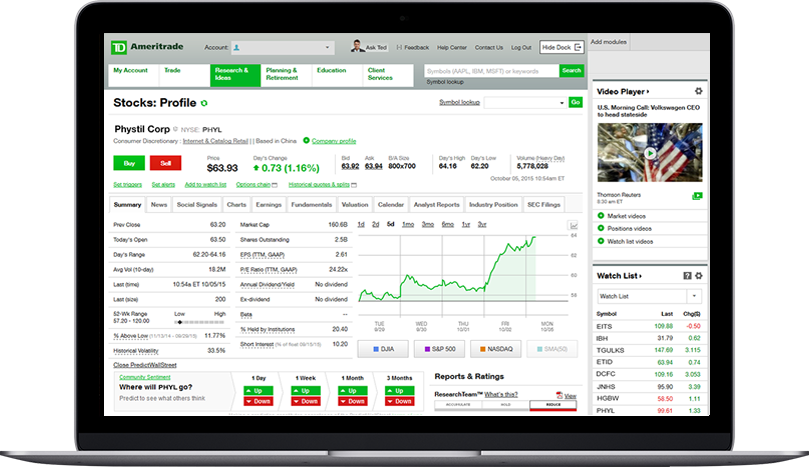

One of the standout features of TD Ameritrade is its advanced trading platform, thinkorswim. This platform offers a range of powerful tools and features that cater to both beginner and experienced traders. From advanced charting and analysis tools to customizable watchlists and a wide range of order types, thinkorswim provides traders with everything they need to make informed trading decisions.

TD Ameritrade also offers a wide range of educational resources to help traders enhance their skills and knowledge. They provide webinars, tutorials, and articles covering various trading topics, including technical analysis, fundamental analysis, and risk management. This commitment to education sets TD Ameritrade apart and makes it a suitable choice for traders of all levels.

In terms of product offerings, TD Ameritrade provides traders with access to an extensive range of markets, including Forex, stocks, options, futures, and more. This allows traders to diversify their portfolios and take advantage of different market opportunities.

Key Benefits:

Wide Range of Products: TD Ameritrade offers a wide range of products for trading, including stocks, options, futures, forex, and ETFs. This allows traders to diversify their investment portfolios and take advantage of various market opportunities.

Advanced Trading Platform: The broker provides a powerful and intuitive trading platform called thinkorswim. This platform offers advanced charting tools, real-time data, customizable layouts, and a wide range of technical indicators. It also provides access to advanced order types and a paper trading feature for practice purposes.

Educational Resources: TD Ameritrade understands the importance of education in trading. They offer a vast array of educational resources, including webinars, video tutorials, articles, and courses. These resources cater to traders of all levels, from beginners to experienced professionals, and cover a wide range of topics such as technical analysis, fundamental analysis, and trading strategies.

Research Tools: The broker provides comprehensive research tools to help traders make informed trading decisions. Their research platform offers real-time market data, analyst reports, earnings calendars, and customizable watchlists. They also provide access to third-party research from reputable sources such as Morningstar and CFRA.

Investor Community: TD Ameritrade has a strong investor community where traders can interact with other like-minded individuals, share trading ideas, and learn from each other’s experiences. This community can be accessed through their platform, allowing traders to engage in discussions and gain insights from a diverse group of investors.

Customer Support: TD Ameritrade offers excellent customer support, with multiple channels for assistance. Traders can reach out to their support team via phone, email, or live chat. Additionally, they have a comprehensive FAQ section and a dedicated support center on their website, which provides answers to common queries and technical issues.

Regulated and Secure: TD Ameritrade is a well-established broker regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). This provides traders with peace of mind, knowing that their funds are held in segregated accounts and that the broker operates under strict regulatory guidelines.

Mobile Trading: TD Ameritrade offers mobile trading apps for both iOS and Android devices. These apps provide traders with the convenience of trading on-the-go, allowing them to monitor their accounts, execute trades, and access real-time market data from anywhere at any time.

Competitive Pricing: TD Ameritrade offers competitive pricing for their services, including low commission rates for stock and options trades. They also provide commission-free ETF trading and access to a large selection of no-load mutual funds. Additionally, they offer various account types and flexible funding options to suit different trading needs.

Pros

- Wide range of trading platforms, including the highly popular thinkorswim platform.

- Vast selection of financial instruments, including forex, stocks, options, futures, and more.

- Competitive pricing with no minimum deposit requirement.

- Educational resources and tools to help traders improve their skills and knowledge.

- Excellent customer support, including phone, email, and live chat options.

- Regulated by reputable authorities, ensuring a safe and secure trading environment.

- Advanced trading tools and features for active and experienced traders.

- User-friendly interface and customizable trading experience.

- Access to real-time market data and research tools to assist traders in making informed decisions.

- Robust mobile trading app for on-the-go trading.

Cons

- High trading fees

- Limited range of tradable instruments

- Limited educational resources for beginner traders

- No dedicated account manager for small account holders

- Lack of competitive promotions or bonuses

- Limited availability of customer support channels

- No social trading features

- Limited research tools compared to other brokers

- Inactivity fees for dormant accounts

- Limited options for automated trading strategies

My Recommendation

As an experienced trader in the Forex market, I have had the opportunity to use TD Ameritrade as my broker. Overall, my experience with TD Ameritrade has been positive. The platform is user-friendly and offers a wide range of tools and resources for both beginner and advanced traders. The customer support is also excellent, with prompt responses and helpful guidance.

One of the standout features of TD Ameritrade is its Thinkorswim platform, which is highly customizable and provides advanced charting and analysis tools. Additionally, the broker offers competitive pricing with no hidden fees. However, one drawback I found is that the spreads can be slightly higher compared to some other brokers in the market.

OANDA

OANDA is a well-established and highly reputable Forex broker that has been in operation for over 25 years. Founded in 1996, the company has built a strong reputation for providing reliable and transparent trading services to traders around the world. With its headquarters in the United States, OANDA is regulated by multiple regulatory bodies, including the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA).

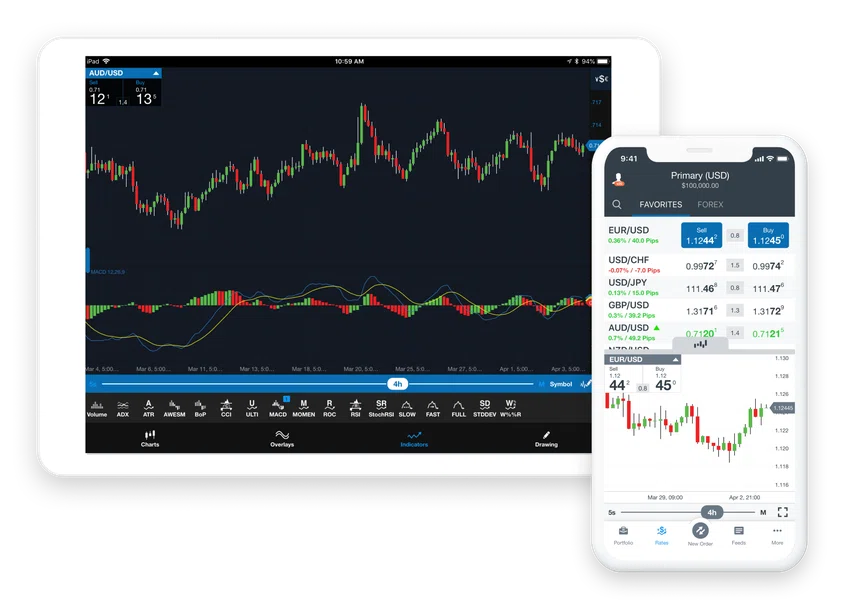

One of the standout features of OANDA is its proprietary trading platform, known as the OANDA Trade platform. This platform offers a user-friendly interface, advanced charting tools, and a wide range of technical indicators to assist traders in analyzing the markets. Additionally, OANDA also supports the popular MetaTrader 4 (MT4) platform, giving traders the option to choose the platform they are most comfortable with.

OANDA provides a comprehensive range of trading instruments, including major, minor, and exotic currency pairs, as well as precious metals and commodities. Traders can access these markets through various account types, such as the OANDA Core Account, which offers competitive spreads and no commission fees, and the OANDA Premium Account, which provides tighter spreads but charges a commission per trade.

Another notable feature of OANDA is its commitment to transparency. The broker provides real-time market data, including live spreads, historical price data, and client sentiment indicators. This level of transparency allows traders to make informed trading decisions based on accurate and up-to-date information.

OANDA also offers a range of educational resources and tools to help traders improve their trading skills. These resources include webinars, video tutorials, and a comprehensive knowledge base. Additionally, OANDA provides a demo account that allows traders to practice their strategies in a risk-free environment before trading with real money.

In terms of customer support, OANDA offers multilingual support through email, live chat, and telephone. The support team is known for being responsive and knowledgeable, providing timely assistance to traders whenever needed.

Overall, OANDA is a highly respected Forex broker that offers a reliable and transparent trading environment. With its advanced trading platforms, wide range of trading instruments, and commitment to customer satisfaction, OANDA is a top choice for both beginner and experienced traders in the Forex market.

Key Benefits:

OANDA is a well-established and highly respected online broker in the Forex industry, having been founded in 1996.

One of the standout features of OANDA is its proprietary trading platform, called OANDA Trade, which is available on both desktop and mobile devices. The platform is user-friendly, intuitive, and offers a wide range of advanced trading tools and charting capabilities.

OANDA provides access to a vast selection of financial instruments, including major, minor, and exotic currency pairs, as well as CFDs on indices, commodities, bonds, and precious metals. This enables traders to diversify their portfolios and take advantage of various market opportunities.

The broker offers competitive pricing and tight spreads, making it an attractive choice for both retail and institutional traders. OANDA also provides transparent pricing with no hidden fees or commissions, which is appreciated by its clients.

OANDA is known for its excellent execution speeds and reliable order execution. The broker utilizes innovative technology to ensure that trades are executed without delays, slippage, or requotes, allowing traders to enter and exit positions at their desired prices.

Pros

- Regulated by multiple financial authorities, including the FCA and CFTC

- Wide range of trading instruments, including forex, commodities, and indices

- Competitive spreads and transparent pricing

- No minimum deposit requirement

- Advanced trading platform with customizable features

- User-friendly interface and intuitive charting tools

- Access to a comprehensive suite of educational resources

- Excellent customer support with 24/5 availability

- Multiple account types to cater to different trading needs

- Innovative tools like Autochartist and MarketPulse for market analysis and trading ideas.

Cons

- Limited product offering compared to other brokers

- Higher spreads compared to some other brokers

- Limited educational resources for beginner traders

- Limited payment options for deposits and withdrawals

- No welcome bonus or promotional offers for new clients

- Limited customer support options, no live chat available

- No social trading or copy trading features available

My Recommendation

As an experienced trader in the Forex industry, I have had the opportunity to use OANDA as a broker for my trading activities. Overall, I have found OANDA to be a reliable and trustworthy broker. Their platform is user-friendly and offers a wide range of trading instruments, including major and minor currency pairs, commodities, and indices.

One of the standout features of OANDA is their competitive spreads, which are consistently tight and transparent. This allows for more favorable trading conditions and reduces the cost of trading. Additionally, their customer support team is responsive and helpful, always ready to assist with any queries or concerns.

Considering my personal experience with OANDA, I would definitely recommend this broker for trading. Their strong reputation, competitive spreads, and reliable platform make them a reliable choice for both beginner and experienced traders.

Forex.com

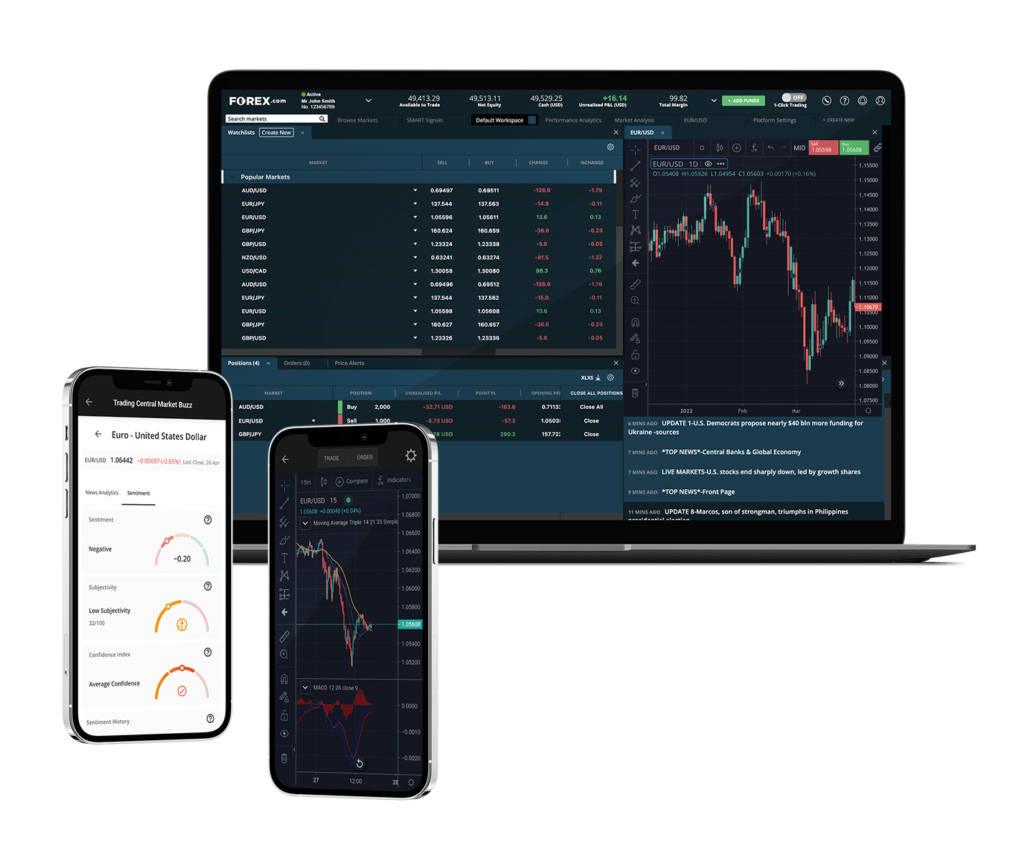

Forex.com is a well-established and reputable online Forex broker, offering a wide range of trading services to traders from around the world. With over 20 years of experience in the industry, Forex.com has built a strong reputation for providing reliable and transparent trading conditions.

One of the key advantages of trading with Forex.com is its extensive product offering. Traders can access a wide range of currency pairs, including major, minor, and exotic pairs. In addition to forex, Forex.com also offers trading opportunities in other financial markets, including indices, commodities, and cryptocurrencies. This allows traders to diversify their portfolios and take advantage of various market opportunities.

In terms of trading platforms, Forex.com offers its proprietary platform, as well as the popular MetaTrader 4 (MT4) platform. The Forex.com platform is user-friendly and provides access to advanced charting tools, real-time market data, and a wide range of order types. MT4, on the other hand, is a highly customizable platform that is favored by many traders for its advanced technical analysis tools, expert advisors, and automated trading capabilities.

Forex.com also caters to the needs of different types of traders by offering various account types. Whether you are a beginner or an experienced trader, you can choose from a standard account or an Active Trader account. The Active Trader account is specifically designed for high-volume traders and offers tighter spreads and dedicated support.

Key Benefits:

Established Reputation: Forex.com is one of the most recognized and trusted names in the Forex industry, with a solid track record dating back to 2001. It is a subsidiary of GAIN Capital Holdings, a publicly-traded company listed on the New York Stock Exchange.

Regulated Broker: Forex.com operates under the regulatory oversight of multiple reputable authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Commodity Futures Trading Commission (CFTC) in the United States. This ensures a high level of transparency and client protection.

Range of Tradable Instruments: Forex.com offers a diverse range of tradable instruments, including major, minor, and exotic currency pairs, as well as popular commodities like gold, silver, and oil. Additionally, clients can access a variety of global indices and cryptocurrencies.

Competitive Spreads and Pricing: The broker provides competitive spreads on major currency pairs, starting from as low as 0.2 pips. Traders can also benefit from transparent pricing, as Forex.com operates a no-dealing-desk (NDD) execution model, ensuring tight spreads and fast order execution.

Multiple Trading Platforms: Forex.com offers a selection of powerful and user-friendly trading platforms to suit different trading styles and preferences. This includes the popular MetaTrader 4 (MT4) platform, as well as their proprietary platform, ForexTrader, which is available on both desktop and mobile devices.

Advanced Trading Tools: The broker provides a range of advanced trading tools to help traders make informed decisions and enhance their trading strategies. These tools include real-time market analysis, customizable charts with a wide range of technical indicators, and access to economic news and events.

Education and Research: Forex.com offers comprehensive educational resources and research materials to help traders improve their knowledge and skills. This includes webinars, video tutorials, trading guides, and market analysis from their team of experts.

Account Types and Funding Options: Forex.com offers different account types, catering to both beginner and experienced traders. Clients can choose between standard accounts and commission-based accounts. The broker also provides a variety of funding options, including bank transfers, credit/debit cards, and popular e-wallets.

Excellent Customer Support: Forex.com prides itself on its dedicated customer support team, available 24/5 through phone, email, and live chat. Traders can receive assistance with account-related inquiries, technical issues, and trading inquiries promptly and professionally.

Risk Management Tools: The broker offers a range of risk management tools to help traders mitigate their exposure to market volatility. This includes stop loss orders, take profit orders, and trailing stops. Additionally, Forex.com provides negative balance protection, ensuring that clients cannot lose more than their account balance.

Global Presence: With offices in multiple countries, including the United States, the United Kingdom, Australia, and Singapore, Forex.com caters to a global clientele. This global presence allows traders to access the Forex market from various regions and benefit from localized support.

Pros

- Regulated by multiple reputable financial authorities

- Wide range of trading instruments available

- Competitive spreads and low fees

- User-friendly trading platform with advanced charting tools

- Access to educational resources and research materials

- Efficient customer support services

- Flexible account types to suit different trading needs

- Option to trade on mobile devices

- Multiple deposit and withdrawal methods available

- Strong reputation and history in the Forex industry

Cons

- High minimum deposit requirement

- Limited selection of trading instruments

- High spreads compared to other brokers

- Limited educational resources for beginners

- Lack of advanced trading tools and features

- Limited customer support options

- No social trading features

- Inactivity fees for dormant accounts

- Limited deposit and withdrawal options

- Not regulated in all countries

My Recommendation

I have had the opportunity to trade with Forex.com, and I must say that my experience with this broker has been quite positive. One of the standout features of Forex.com is its user-friendly trading platform, which provides a seamless trading experience. The platform is packed with a wide range of trading tools and indicators, making it suitable for both beginner and advanced traders.

Moreover, Forex.com offers competitive spreads and a diverse range of tradable instruments, including major and minor currency pairs, indices, commodities, and cryptocurrencies. The broker also provides excellent customer support, with a responsive team always ready to assist with any inquiries or issues. Overall, based on my personal experience, I would highly recommend Forex.com for traders looking for a reliable and feature-rich broker in the Forex market.

IG US

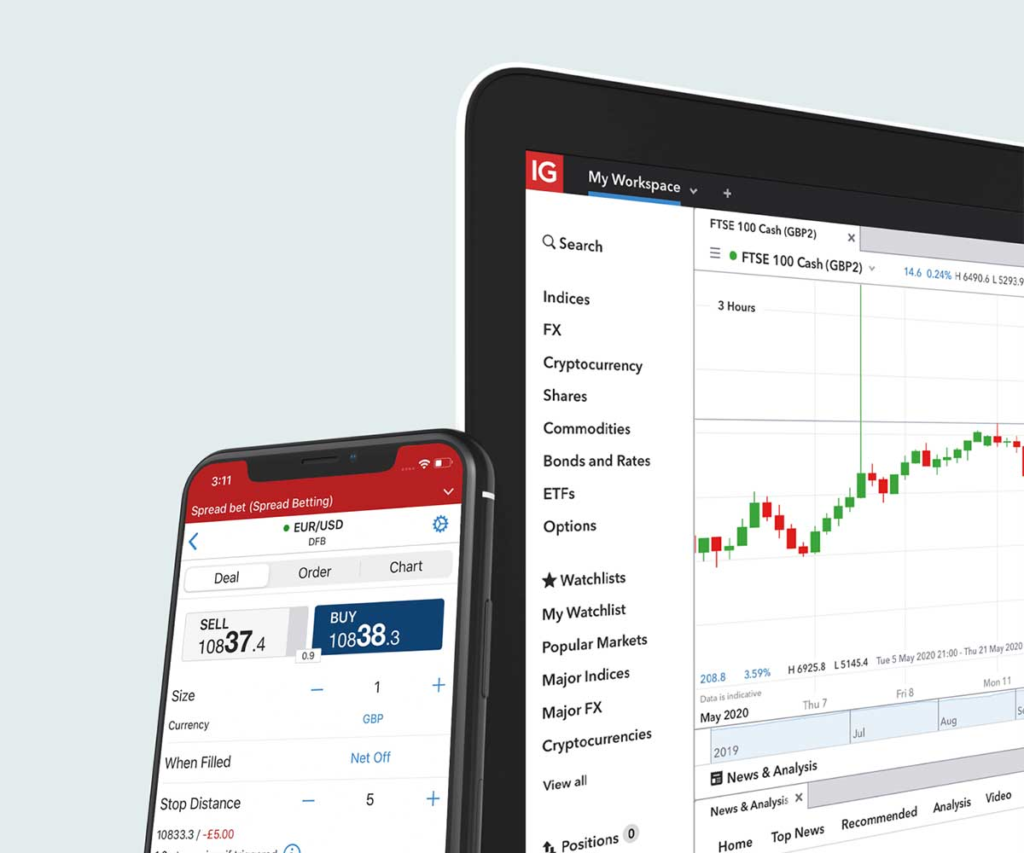

IG US is a leading Forex broker that offers a wide range of financial instruments and trading services to clients in the United States. As a subsidiary of IG Group, a globally recognized and trusted brand in the financial industry, IG US provides traders with a secure and regulated platform to access the Forex market.

Key Benefits:

Regulated Broker: IG US is a reputable and regulated broker, authorized and regulated by the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) in the United States. This ensures that traders’ funds are protected and that the broker operates in a transparent and fair manner.

Wide Range of Markets: IG US offers a wide range of markets for traders to choose from, including forex, indices, commodities, and cryptocurrencies. This allows traders to diversify their portfolio and take advantage of various market opportunities.

Competitive Spreads: IG US offers competitive spreads on major currency pairs, ensuring that traders can execute their trades at favorable prices. Tight spreads contribute to reducing trading costs and improving profitability.

Advanced Trading Platform: IG US provides traders with a powerful and user-friendly trading platform. The platform is equipped with advanced charting tools, multiple order types, and a wide range of technical indicators. Additionally, it offers customizable layouts and real-time market news and analysis.

Educational Resources: IG US understands the importance of education in trading and provides traders with a wealth of educational resources. These resources include video tutorials, webinars, trading guides, and a comprehensive glossary of trading terms. This helps both beginner and experienced traders to enhance their trading skills and knowledge.

Excellent Customer Support: IG US provides excellent customer support, ensuring that traders receive assistance whenever they need it. Customer support is available 24/5 via phone, email, and live chat. Additionally, the broker offers a dedicated support team that can assist with any technical or account-related issues.

Demo Account: IG US offers a demo account that allows traders to practice their trading strategies in a risk-free environment. The demo account is an invaluable tool for beginners to familiarize themselves with the trading platform and test their trading strategies before risking real money.

Research and Analysis Tools: IG US provides traders with access to a wide range of research and analysis tools. These tools include real-time market news, economic calendars, market analysis, and trading signals. This helps traders to stay informed about market trends and make well-informed trading decisions.

Safe and Secure Trading Environment: IG US ensures a safe and secure trading environment by implementing advanced security measures. This includes encryption technology to protect traders’ personal and financial information and segregated accounts to safeguard clients’ funds.

Competitive Leverage: IG US offers competitive leverage options, allowing traders to amplify their trading positions. However, it’s important to note that leverage can magnify both profits and losses, so it should be used with caution.

Seamless Account Funding: IG US provides traders with a variety of convenient and secure methods for depositing and withdrawing funds. These methods include bank transfers, credit/debit cards, and electronic wallets, making account funding quick and hassle-free.

Pros

- Regulated by the Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA)

- Wide range of trading instruments including Forex, indices, commodities, cryptocurrencies, and more

- Competitive spreads and low trading fees

- Advanced trading platforms with a user-friendly interface

- Access to educational resources and research tools

- Excellent customer service and support

- Robust security measures to protect client funds and personal information

- Multiple account types to suit different trading needs

- Convenient deposit and withdrawal options

- Strong reputation in the industry with a long track record of success

Cons

- Limited product offerings compared to other brokers

- High minimum deposit requirement

- Inactivity fees charged after only 2 years of account inactivity

- Limited educational resources for beginner traders

- Limited customer support options, only available via email or phone

My Recommendation

IG US is a reputable Forex broker that I have had the pleasure of using for my trading needs. The platform is user-friendly and offers a wide range of trading instruments, including major and minor currency pairs, indices, commodities, and cryptocurrencies. The execution speed is impressive, ensuring that my trades are executed promptly.

One notable aspect of IG US is their customer service. The support team is knowledgeable and responsive, always ready to assist with any queries or issues that may arise. Additionally, the broker provides educational resources, including webinars and market analysis, which have helped me make informed trading decisions.

Overall, I would highly recommend IG US to both beginner and experienced traders. The platform’s reliability, extensive range of trading options, and excellent customer service make it a top choice for anyone in the Forex market.

Charles Schwab

Charles Schwab is a well-established and highly reputable broker in the Forex industry. With over 40 years of experience, they have become a trusted name among traders. The broker offers a wide range of services and features that cater to both beginner and advanced traders.

One of the key strengths of Charles Schwab is their robust trading platform. The platform is user-friendly and comes with a variety of tools and indicators to assist traders in making informed decisions. Additionally, they provide access to a vast number of currency pairs, allowing traders to diversify their portfolios.

In terms of safety and security, Charles Schwab is regulated by top-tier financial authorities, providing clients with peace of mind. They also offer competitive pricing and low spreads, making it an attractive choice for cost-conscious traders.

Overall, Charles Schwab is a reliable broker that offers a comprehensive trading experience with excellent customer support and a wide range of trading options.

Key Benefits:

Established Reputation: Charles Schwab is one of the most well-known and respected brokerage firms in the industry, with over 50 years of experience in the financial markets. They have built a solid reputation for providing reliable and trustworthy services.

Range of Investment Products: Charles Schwab offers a wide range of investment products, including stocks, bonds, mutual funds, ETFs, options, futures, and more. This allows traders and investors to diversify their portfolios and access various asset classes.

Competitive Pricing: The broker offers competitive pricing, with low commissions and fees. They have a transparent fee structure, allowing traders to easily understand the costs associated with their trades. Additionally, they offer a selection of commission-free ETFs and mutual funds, making it cost-effective for investors.

Trading Platforms: Charles Schwab provides multiple trading platforms to cater to different trading styles and preferences. Their flagship platform, StreetSmart Edge, offers advanced charting tools, real-time streaming quotes, customizable layouts, and a wide range of research and analysis tools. They also have a user-friendly web-based platform and mobile apps for on-the-go trading.

Research and Education: Charles Schwab is known for its extensive research and educational resources. They provide market insights, analyst reports, and research from reputable sources. They also offer educational materials, webinars, and workshops to help traders improve their knowledge and skills.

Customer Service: The broker is committed to providing excellent customer service. They have a team of knowledgeable representatives available via phone, email, and live chat to assist clients with any inquiries or issues they may have. Additionally, they have a network of physical branches across the United States for in-person support.

Robust Security: Charles Schwab prioritizes the security of client funds and personal information. They use advanced encryption technology to protect data and have multiple layers of security measures in place. They are also a member of the Securities Investor Protection Corporation (SIPC), providing additional protection for clients’ assets.

Account Options: Charles Schwab offers various types of accounts, including individual brokerage accounts, retirement accounts (IRAs), education savings accounts (ESAs), and more. They cater to different investment goals and provide specialized account features for specific needs.

Additional Services: In addition to brokerage services, Charles Schwab offers banking services, including checking accounts, savings accounts, and mortgages. They also provide access to financial planning services and professional portfolio management for clients who prefer a hands-off approach.

Pros

- Established and reputable brokerage firm with over 45 years of experience in the financial industry.

- Wide range of investment options including stocks, bonds, mutual funds, ETFs, options, futures, and Forex.

- Competitive pricing with low commissions and fees.

- User-friendly trading platform with advanced tools and features.

- Access to extensive research and educational resources.

- Excellent customer service with 24/7 support.

- Strong security measures to protect clients’ personal and financial information.

- Robust mobile trading app for on-the-go trading.

- Integration with other financial services such as banking and retirement accounts.

- Availability of managed portfolios for hands-off investing.

Cons

- High commission fees

- Limited number of currency pairs available

- Slow execution speed

- Complex trading platform

- Limited educational resources for beginners

- No social trading feature

- Limited customer support options

My Recommendation

The customer service is top-notch, with knowledgeable representatives always available to assist me with any queries or concerns. One of the standout features of Charles Schwab is the extensive research and educational materials they provide.

Whether you are a beginner or a seasoned trader, the broker offers a wealth of resources to help you stay updated on market trends and improve your trading skills. Additionally, the competitive pricing and low fees make it an attractive option for traders looking for cost-effective solutions.

Overall, I would highly recommend Charles Schwab as a broker for trading. The combination of a user-friendly platform, excellent customer service, and comprehensive educational resources make it a reliable and trustworthy choice for both beginners and experienced traders.

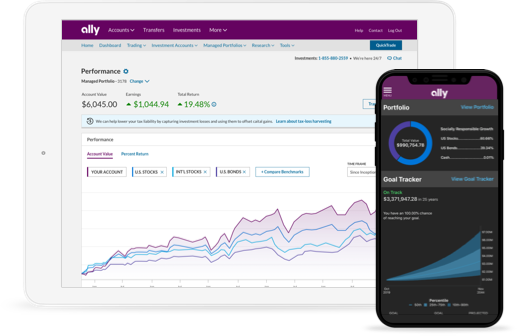

Ally Invest

Ally Invest is a well-established online brokerage firm that offers a range of investment products and services to traders and investors. With its robust platform and competitive pricing, it has gained popularity among both beginners and experienced traders.

One of the key features of Ally Invest is its user-friendly trading platform, which provides a seamless trading experience. It offers a variety of investment options, including stocks, options, ETFs, mutual funds, and bonds. Traders can access real-time market data, advanced charting tools, and customizable watchlists, enabling them to make informed investment decisions.

In terms of pricing, Ally Invest stands out with its low-cost structure. It offers competitive commission rates, which are particularly appealing to active traders. Additionally, it provides a range of educational resources, including webinars, articles, and tutorials, to help traders improve their trading skills and knowledge.

Overall, Ally Invest is a reliable brokerage firm that offers a comprehensive suite of investment products and services. With its user-friendly platform, competitive pricing, and educational resources, it is a suitable choice for traders and investors looking for a dependable online broker.

Key Benefits:

Competitive pricing: Ally Invest offers competitive pricing on its forex trades, with spreads starting from as low as 1 pip. This allows traders to execute trades at a lower cost, maximizing their potential profits.

Advanced trading platforms: Ally Invest provides traders with a range of advanced trading platforms, including the popular MetaTrader 4 (MT4) platform. MT4 is known for its user-friendly interface, advanced charting tools, and a wide range of technical indicators, making it suitable for both beginner and experienced traders.

Wide range of tradable instruments: Apart from forex, Ally Invest also offers trading in other financial instruments such as stocks, options, futures, and ETFs. This allows traders to diversify their portfolios and take advantage of various market opportunities.

Educational resources: Ally Invest provides a comprehensive range of educational resources to help traders enhance their trading knowledge and skills. These resources include webinars, video tutorials, articles, and a dedicated educational section on their website. Beginner traders can also benefit from their demo account, which allows them to practice trading with virtual money before risking real funds.

Research and analysis tools: Ally Invest offers a variety of research and analysis tools to help traders make informed trading decisions. These tools include real-time market data, economic calendars, technical analysis tools, and market commentary from industry experts. Traders can access these tools through their trading platforms or the Ally Invest website.

Customer support: Ally Invest is known for its excellent customer support. Traders can reach their support team via phone, email, or live chat. The support team is available 24/7 and is known for its prompt and professional assistance.

Regulated and trusted: Ally Invest is a regulated broker, ensuring that traders’ funds are protected and that the broker operates in compliance with industry standards. It is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC), providing additional security to traders.

Account types and options: Ally Invest offers a variety of account types to suit different trading needs. These include individual, joint, and corporate accounts, as well as traditional and Roth IRAs for retirement investing. Traders can also choose between standard and margin accounts, depending on their risk tolerance and trading strategy.

Competitive promotions and bonuses: Ally Invest often runs promotions and offers bonuses to new and existing traders. These promotions may include cash bonuses, commission-free trades, or reduced trading fees. Traders should keep an eye on their website or contact customer support for the latest offers.

Mobile trading: Ally Invest provides mobile trading apps for both iOS and Android devices, allowing traders to access their accounts and trade on the go. These mobile apps offer the same features and functionality as the desktop platforms, ensuring a seamless trading experience across devices.

Pros

- Competitive pricing and low commissions

- Wide range of investment options, including forex, stocks, bonds, and options

- User-friendly and intuitive trading platform

- Access to advanced trading tools and research resources

- Excellent customer support services

- No minimum deposit requirement

- Strong financial backing and a trusted brand name

- Seamless integration with Ally Bank accounts for easy fund transfers

- Robust security measures to protect clients’ personal and financial information

Cons

- Limited product offerings

- High minimum deposit requirement

- Lack of educational resources

- Limited customer support options

- Inactivity fees charged

My Recommendation

As an experienced trader in the Forex market, I have had the opportunity to use Ally Invest as a broker. Overall, my experience with Ally Invest has been positive. The platform is user-friendly and offers a wide range of trading tools and resources, which is beneficial for both beginner and experienced traders.

One of the standout features of Ally Invest is its competitive pricing structure. With low commission fees and no account minimums, it makes it accessible for traders of all levels. Additionally, the customer support team at Ally Invest is responsive and helpful, which is crucial when dealing with any issues that may arise during trading.

In conclusion, based on my personal experience, I would definitely recommend Ally Invest as a reliable broker for Forex trading. The combination of a user-friendly platform, competitive pricing, and excellent customer support makes it a suitable choice for traders looking for a reliable and accessible broker.

Fidelity

Fidelity is a well-known and reputable brokerage firm that has been serving clients for over 70 years. With a strong focus on investor education and research, Fidelity offers a wide range of investment products and services, including trading in the Forex market.

One of the key advantages of trading with Fidelity is their comprehensive research and analysis tools. Traders have access to a wealth of market data, real-time quotes, and advanced charting features that can help them make informed trading decisions. Additionally, Fidelity provides a variety of educational resources, including webinars, articles, and tutorials, to help traders improve their skills and knowledge.

Fidelity also offers competitive pricing and a user-friendly trading platform. Traders can execute trades quickly and easily, and the platform is customizable to suit individual preferences. Furthermore, Fidelity provides excellent customer service, with support available via phone, email, and live chat.

Overall, Fidelity is a trusted and reliable broker that offers a range of features and services to cater to both beginner and experienced Forex traders.

Key Benefits:

Established Reputation: Fidelity is a renowned and trusted name in the financial industry with a long history dating back to 1946. It has built a strong reputation for its reliable and secure services.

Range of Products: Fidelity offers a wide range of investment products, including stocks, bonds, mutual funds, ETFs, options, futures, and forex. This allows traders to diversify their portfolio and explore different investment opportunities.

Research and Analysis Tools: Fidelity provides comprehensive research and analysis tools to help traders make informed investment decisions. These tools include real-time quotes, market analysis, technical indicators, and customizable charting options.

Trading Platforms: Fidelity offers a user-friendly and intuitive trading platform called Active Trader Pro, which is suitable for both beginner and experienced traders. The platform provides advanced trading features, including advanced order types, real-time streaming data, and customizable layouts.

Education and Resources: Fidelity offers a range of educational resources, including articles, videos, webinars, and online courses. These resources are designed to help traders improve their knowledge and skills in trading and investing.

Customer Support: Fidelity provides excellent customer support with a team of dedicated professionals available via phone, email, and live chat. They are known for their prompt response and helpful assistance, ensuring that traders have a smooth trading experience.

Account Types: Fidelity offers various account types to cater to different trading needs, including individual, joint, retirement, and business accounts. They also provide specialized accounts such as custodial accounts for minors and trusts.

Security and Regulation: Fidelity is regulated by reputable financial authorities, ensuring a high level of security and transparency. They employ advanced encryption technology and stringent security measures to protect clients’ funds and personal information.

Mobile Trading: Fidelity offers a mobile trading app that allows traders to access their accounts and trade on the go. The app provides real-time quotes, portfolio tracking, and trading capabilities, making it convenient for traders to manage their investments anytime, anywhere.

Competitive Pricing: Fidelity offers competitive pricing with low commission fees and no account maintenance or inactivity fees. This makes it a cost-effective choice for traders, especially those who execute frequent trades.

Pros

- Trusted and well-established broker with over 70 years of experience in the financial industry

- Wide range of investment options including stocks, bonds, mutual funds, ETFs, and forex

- User-friendly and intuitive trading platform with advanced tools and features

- Excellent customer service and support, available 24/7

- Competitive pricing and low fees for trades and investments

- Strong research and educational resources for investors of all levels

- Access to a vast network of research and analysis from industry experts

- Robust security measures to protect client funds and personal information

- Comprehensive account management options for individual investors and institutional clients

- Strong track record of performance and reliability in executing trades and fulfilling orders.

Cons

- Limited range of available currency pairs

- High minimum deposit requirement

- Limited educational resources for beginner traders

- Lack of advanced trading tools and features

- Limited customer support options

- Inactivity fees for dormant accounts

- Limited promotions and bonuses for clients

- Limited payment methods for deposits and withdrawals

- Limited research and analysis tools for traders

- Lack of social trading features

My Recommendation

Overall, my experience with Fidelity has been positive. The platform is user-friendly and offers a wide range of trading tools and resources. The execution speed is fast, and I have never encountered any major technical issues.

One aspect that stands out for me is the customer support provided by Fidelity. The support team is responsive and knowledgeable, always ready to assist with any queries or concerns. In terms of security, Fidelity takes the protection of client funds seriously, and they have robust measures in place.

I would definitely recommend it as a reliable broker for Forex trading. The platform’s features, combined with excellent customer service, make it a trustworthy choice for both beginner and experienced traders.

Forex Capital Markets (FXCM)

Forex Capital Markets (FXCM) is a well-established and reputable broker that has been in operation for over 20 years. With its headquarters in the United States, FXCM is regulated by multiple financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC). This ensures that clients’ funds are held in segregated accounts and provides a level of security and trust.

FXCM offers a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies. They provide access to various trading platforms, including MetaTrader 4 (MT4) and their proprietary Trading Station platform, which is user-friendly and packed with advanced trading tools. Additionally, FXCM offers educational resources and market analysis to help traders enhance their skills and make informed trading decisions.

Overall, FXCM is a reliable and transparent broker that caters to both beginner and experienced traders. Their strong regulatory framework, diverse range of trading instruments, and comprehensive trading platforms make them a popular choice among traders worldwide.

Key Benefits:

Regulation: FXCM is regulated by multiple reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) in Australia. This ensures that the broker operates under strict guidelines and offers a high level of client protection.

Account Types: FXCM offers a range of account types to cater to different trading needs. These include the Standard Account, Active Trader Account, and Professional Account. Each account type comes with varying features, such as different minimum deposit requirements, spreads, and commission structures.

Trading Platforms: FXCM provides access to various trading platforms, including the popular MetaTrader 4 (MT4) and their proprietary Trading Station platform. These platforms offer advanced charting tools, technical indicators, and the ability to execute trades quickly and efficiently.

Range of Instruments: Traders can access a wide range of financial instruments through FXCM. This includes major and minor currency pairs, as well as commodities, indices, and cryptocurrencies. The availability of diverse instruments allows traders to diversify their portfolios and take advantage of different market opportunities.

Customer Support: FXCM offers customer support services through various channels, including phone, email, and live chat. Their support team is available 24/5 to assist clients with any inquiries or issues they may have. Additionally, the broker provides multilingual support, catering to clients from different countries.

Execution Speed and Technology: FXCM uses advanced technology to ensure fast and reliable order execution. The broker offers no dealing desk (NDD) execution, meaning trades are executed directly in the market without any interference. This helps to minimize delays and slippage, providing traders with better trading conditions.

Risk Management Tools: FXCM provides traders with a range of risk management tools to help them manage their positions effectively. These tools include stop-loss orders, take-profit orders, and trailing stops. Traders can set these parameters to automatically close or adjust their positions when certain price levels are reached.

Research and Analysis: FXCM offers a variety of research and analysis tools to assist traders in making informed trading decisions. This includes access to real-time market data, economic calendars, and in-depth market analysis reports. Traders can stay updated with the latest market news and trends to identify potential trading opportunities.

Mobile Trading: FXCM provides mobile trading capabilities, allowing traders to access their accounts and trade on the go. The broker offers mobile apps for iOS and Android devices, which offer full trading functionality, real-time quotes, and account management features.

Partnership Programs: FXCM offers partnership programs for individuals and institutions interested in referring clients or becoming an introducing broker. These programs provide attractive commission structures and marketing support to help partners grow their business.

Pros

- Regulated and reputable broker

- Competitive spreads

- Wide range of trading instruments

- Advanced trading platforms

- Multiple account types to suit different trading styles

- Educational resources and webinars for traders of all levels

- Efficient customer support services

- User-friendly and intuitive interface

- Access to market research and analysis tools

- Option to trade on mobile devices

Cons

- History of regulatory issues

- High minimum deposit requirement

- Limited selection of trading instruments

- No Islamic account option

- Inactivity fees

- Limited educational resources

- Lack of transparency in pricing

My Recommendation

The Forex Capital Markets (FXCM) platform is user-friendly and offers a wide range of trading instruments, including forex, commodities, and indices. The execution speed is fast and I have never encountered any major issues with slippage or order rejections.

One aspect that I particularly appreciate about FXCM is their educational resources. They provide comprehensive training materials and webinars, which are especially helpful for beginner traders. Additionally, their customer support team is responsive and knowledgeable.

Overall, I would definitely consider using FXCM for trading. Their reliable platform, extensive educational resources, and responsive customer support make them a reputable choice in the forex industry.

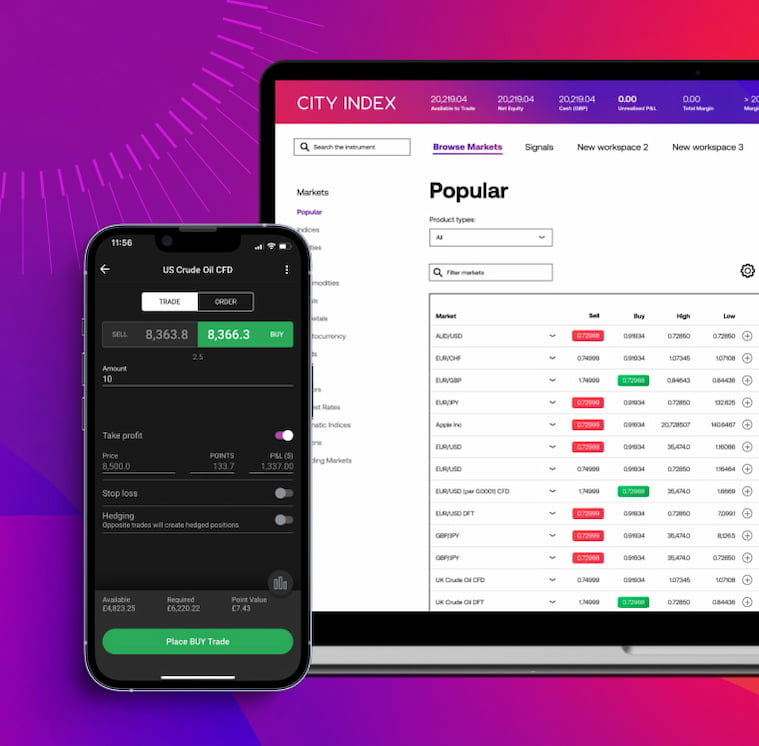

City Index

City Index is a reputable and well-established Forex broker that has been in operation since 1983. With its long-standing history, the broker has built a strong reputation for providing reliable and transparent trading services to traders worldwide.

One of the standout features of City Index is its extensive range of trading instruments. Traders can access a wide variety of Forex currency pairs, as well as other asset classes like indices, commodities, stocks, and cryptocurrencies. This allows traders to diversify their portfolios and take advantage of various market opportunities.

City Index also offers multiple trading platforms, including the popular MetaTrader 4, as well as their proprietary platform, Advantage Web. These platforms are user-friendly and come with advanced charting tools, technical indicators, and various order types, enabling traders to execute their strategies effectively.

Additionally, City Index provides competitive spreads and flexible leverage options, making it suitable for both novice and experienced traders. The broker also offers educational resources, including webinars, tutorials, and market analysis, to help traders improve their trading skills.

Key Benefits:

Offers a wide range of trading instruments, including Forex, indices, commodities, cryptocurrencies, and shares, allowing traders to diversify their portfolio.

Provides access to a variety of trading platforms, including their own proprietary platform, Advantage Web, as well as MetaTrader 4 (MT4), which is a popular choice among traders.

Offers competitive spreads and pricing, ensuring traders can execute their trades at the best possible prices.

Traders can take advantage of flexible leverage options, allowing them to amplify their trading positions and potentially increase their profits.

Provides a range of educational resources and tools, including tutorials, webinars, and market analysis, to help traders improve their skills and make informed trading decisions.

It has a user-friendly mobile trading app, enabling traders to access their accounts and trade on the go from their smartphones or tablets.

The broker provides excellent customer support, with a dedicated team available 24/5 to assist traders with any queries or technical issues.

Multiple funding options, including bank transfer, credit/debit cards, and e-wallets, making it convenient for traders to deposit and withdraw funds from their accounts.

City Index is regulated by respected financial authorities, such as the Financial Conduct Authority (FCA) in the UK, providing traders with peace of mind and ensuring a safe trading environment.

Pros

- Established and reputable broker in the Forex industry

- Wide range of trading instruments including Forex, indices, commodities, and cryptocurrencies

- Competitive spreads and low trading fees

- User-friendly and intuitive trading platform

- Advanced charting tools and technical analysis indicators

- Multiple account types to suit different trading styles and experience levels

- Strong regulatory oversight by top-tier financial authorities

- Comprehensive educational resources and trading tools for beginners and experienced traders

- Excellent customer support available 24/5 via phone, email, and live chat

- Access to research and analysis from industry experts

Cons

- Limited range of tradable instruments

- High minimum deposit requirements

- Limited educational resources and research tools

- Lack of social trading features

- Higher than average spreads and commissions

- No dedicated customer support for non-English speakers

- Limited availability of trading platforms

- Limited deposit and withdrawal options

- No negative balance protection

- Limited promotions and bonuses offered to clients

My Recommendation

The platform is user-friendly and offers a wide range of trading instruments, including currency pairs, indices, commodities, and cryptocurrencies. The execution speed is fast, and I have never experienced any significant slippage or requotes.

One of the standout features of City Index is their excellent customer support. The support team is responsive and knowledgeable, always ready to assist with any queries or issues that may arise. Moreover, the broker provides a comprehensive education center with a variety of resources, including webinars, tutorials, and market analysis, which has helped me enhance my trading skills.

Overall, I would definitely recommend City Index as a reliable broker for Forex trading. The combination of a user-friendly platform, extensive range of trading instruments, and top-notch customer support makes it a trustworthy choice for both beginner and experienced traders.

Conclusion

In conclusion, after thoroughly reviewing the top forex brokers in the USA, it is clear that each of the mentioned brokers has its unique strengths and weaknesses.

TD Ameritrade stands out for its advanced trading platform making it an excellent choice for both beginner and experienced traders.

OANDA offers competitive spreads and a user-friendly interface, making it an attractive option for traders of all levels. Forex.com provides a wide range of tradable assets and a well-regulated trading environment, making it a reliable choice for US traders.

Interactive Brokers offers a comprehensive range of products and competitive pricing, making it an ideal choice for active traders and professionals.

Each one has its own strengths and weaknesses, and is more or less suitable for different cases. But, considering all these factors, if I were to choose one broker, I would recommend TD Ameritrade. Its advanced trading platform and commitment to customer satisfaction make it a standout choice for traders of all levels.

Whether you are a beginner looking for guidance or an experienced trader seeking advanced tools, TD Ameritrade offers a comprehensive solution to cater to your trading needs.